Private Label in Europe: Consistent Growth Across the Retail Landscape

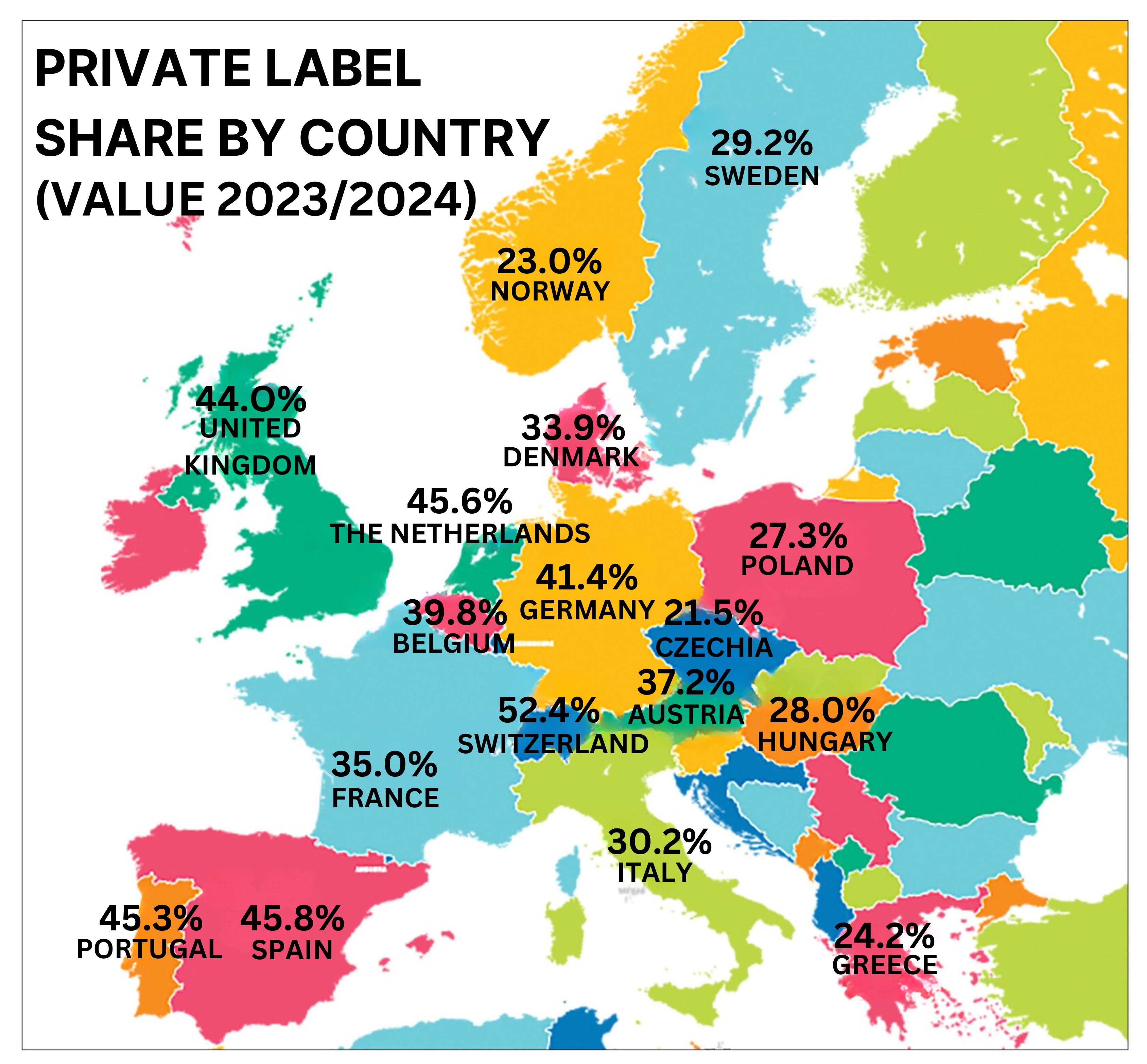

In the latest update of PLMA’s International Private Label Yearbook for the third quarter of 2024, the data shows growing private label market shares across 17 European countries, as reported by NielsenIQ.

The private label share has experienced an overall growth, reaching 38.7% based on the data of the third quarter of 2024, marking a 0.2% increase compared to Q3 of 2023. NielsenIQ's data results shows a significant increase in retail brands across 11 out of the 17 countries analyzed.

European markets continue to dominate in the global private label market, with 11 markets maintaining a market share above 30%, 6 of those markets surpassing the 40% threshold. Significant growth in private label share has been observed in various countries including: Spain (+1.2%), Portugal (+0.8%), France (+0.5%) and Czech Republic (+0.5%). With a slight increase, Switzerland keeps its title as the country with the highest private label share across the 17 countries, at a notable 52.4%.

Private label share in Spain and Portugal is growing with +1.2% increase. Retail brands seem to be particularly thriving in confectionary & snacks, which grew +2.0%. However, the healthcare and petfood categories are experiencing a decline in Spain and Portugal.

While Belgium has kept the same private label share, the Netherlands has declined slightly by 0.4%. Yet, there is still growth visible for the 2 countries in categories like: health care, ambient food, alcoholic beverages and confectionery & snacks.

Scandinavian countries have also shown visible growth in private label with a +0.1% increase in shares. Growth is present in almost all categories, with the highest rise being in health care (+1.9%) and the exceptions being paper products and alcoholic beverages (-0.2%).

In Eastern Europe, private label share is on the rise by +0.4% with the highest growth being in perishable food, home care, and paper products.

According to NielsenIQ’s data, ambient food, confectionery & snacks, and perishable & frozen food take the title of top 3 categories of private label value share with an average of 47.4%. This represents an impressive total of 252 billion in euros with an overall growth of 14 billion euros across the 17 European countries mentioned in this report.

Private label products encompass all merchandise sold under a retailer's brand. That brand can be the retailer's own name or a name created exclusively by that retailer. In some cases, a retailer may belong to a wholesale group that owns the brands that are available to only the members of the group.

Major supermarkets, hypermarkets, drug stores and discounters offer products under the retailer's brand. Private label covers lines of fresh, canned, frozen, and dry foods; snacks, ethnic specialties, pet foods, health and beauty, over-the-counter drugs, cosmetics, household and laundry products, DIY, lawn and garden, paints, hardware, auto care.

For the consumer, private label represents the choice and opportunity to regularly purchase quality food and non-food products at savings compared to manufacturer brands, without waiting for promotional pricing.

Private label items consist of the same or better ingredients than the manufacturer brands, and because the retailer's name or symbol is on the package, the consumer is assured that the product meets the retailer's quality standards and specifications.

Manufacturers of private label products fall into three classifications:

• Large manufacturers who produce both their own brands and private label products.

• Small and medium size manufacturers that specialise in product lines and concentrate on producing private label almost exclusively.

• Major retailers and wholesalers that operate their own manufacturing plants and provide private label products for their stores.