Private Label Across Europe: 2024 Figures Show Another Successful Year

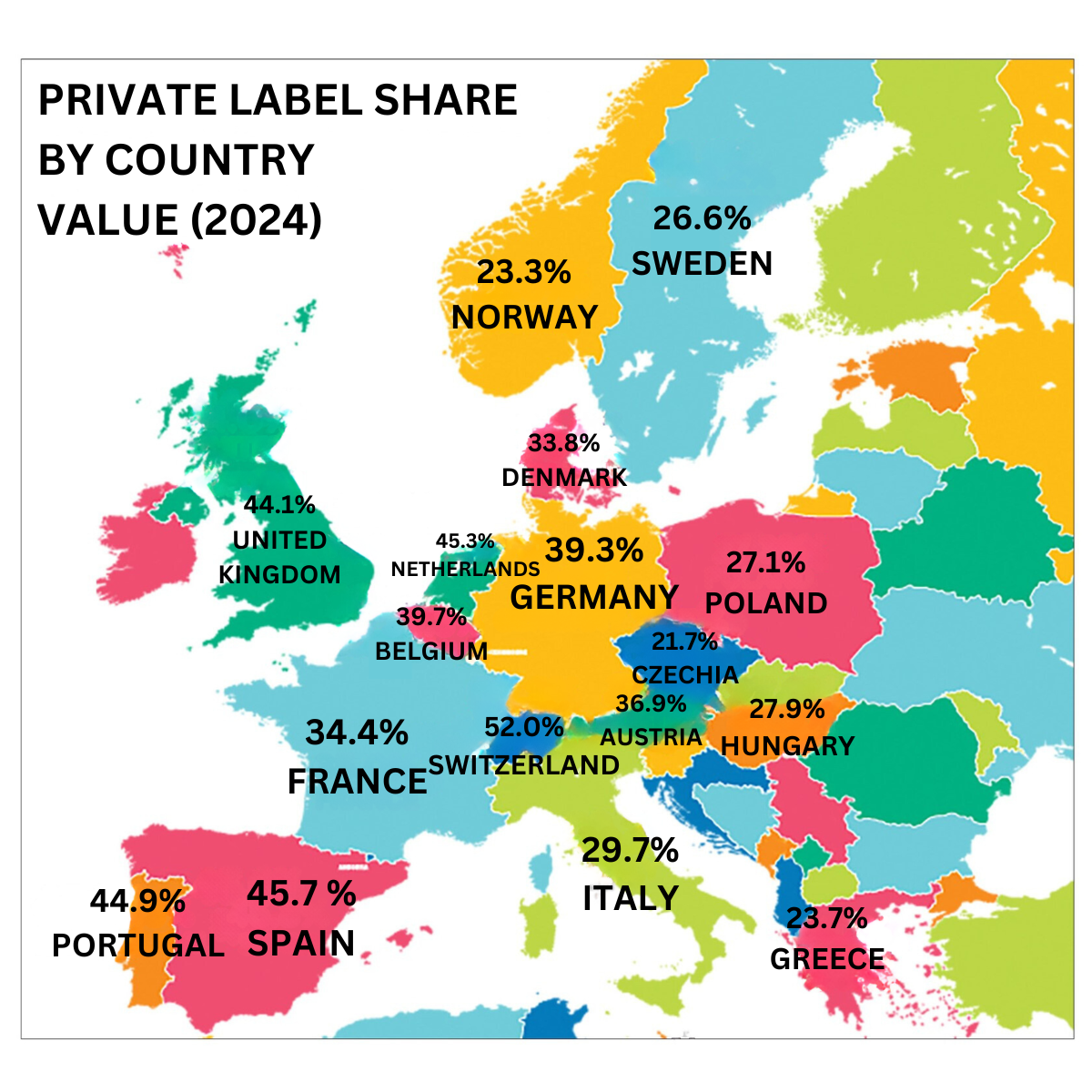

Consumers increasingly turn to Private Label products as shares continue to grow across Europe, according to the date of NielsenIQ. The data shows an increase of +0.11% in shares in comparison to last year (2023). Out of the 17 countries surveyed by NielsenIQ, 9 have shown visible growth. European markets remain some of the biggest Private Label markets globally, 10 markets have a private label share position above 30%, and 5 markets are above 40% of Private Label share.

Southern European countries are the fastest growing in Europe, with Spain taking the lead (+1.2%), Czechia coming in second (+0.5%) and Portugal third (0.4%). Switzerland remains in the lead in European Private Label shares with an impressive 52%, making it the only country surveyed with a share over 50%.

Europe’s dominating markets, Germany and the United Kingdom also show growth in Private Label shares in comparison with last year, with the highest growth being in Ambient food and Alcoholic Beverages.

Portugal and Spain have a shared growth of +1.1%, with the largest share growth being in Frozen Food (+2%). In cooler countries like Belgium and the Netherlands, Private Label declined slightly (-0.3%). However, categories like Health Care, Ambient Food, Confectionary & Snacks, and Alcoholic Beverages are growing in the two countries.

Eastern Europe also shows visible of growth of +0.3% with categories like Home Care, Perishable Food, and Ambient Food becoming more popular. However, across the Scandinavian countries a very slight decline of -0.04% is seen in Private Label shares in categories like Paper Products and Alcoholic Beverages. Other categories like Health Care can be seen growing despite this.

The top categories in Private Label according to NielsenIQ are: Ambient Food, Confectionary & Snacks, and Perishable Food with an average value share of 46.8%, representing an impressive total of 221 billion in Euros across the 17 European countries surveyed with an overall growth of 9.5 billion euros.

Private label products encompass all merchandise sold under a retailer's brand. That brand can be the retailer's own name or a name created exclusively by that retailer. In some cases, a retailer may belong to a wholesale group that owns the brands that are available to only the members of the group.

Major supermarkets, hypermarkets, drug stores and discounters offer products under the retailer's brand. Private label covers lines of fresh, canned, frozen, and dry foods; snacks, ethnic specialties, pet foods, health and beauty, over-the-counter drugs, cosmetics, household and laundry products, DIY, lawn and garden, paints, hardware, auto care.

For the consumer, private label represents the choice and opportunity to regularly purchase quality food and non-food products at savings compared to manufacturer brands, without waiting for promotional pricing.

Private label items consist of the same or better ingredients than the manufacturer brands, and because the retailer's name or symbol is on the package, the consumer is assured that the product meets the retailer's quality standards and specifications.

Manufacturers of private label products fall into three classifications:

• Large manufacturers who produce both their own brands and private label products.

• Small and medium size manufacturers that specialise in product lines and concentrate on producing private label almost exclusively.

• Major retailers and wholesalers that operate their own manufacturing plants and provide private label products for their stores.